About Us

Asia One CPAs is established in 2005 by a team of licensed accountants working and specializing in Taiwan tax regulations and accountings. If you want to do business in Taiwan, you may need the following services to help your business efficiently and smoothly running in Taiwan:

Our Services

- Set up companies or office in Taiwan

- Need (virtual or real) offices in Taiwan

- Open bank accounts in Taiwan

- File VAT forms to Tax Bureau every month(or two months)

- File annual Income Tax return

- Withholding tax on salaries, rental, professional, and other payments

- Keeping of accounting books and records

- Maintain the labor insurance, employee health insurance and employee retirement program

- Consulting in taxation and laws in Taiwan

- FIA and FINI account setting

New Company Consideration

New Company Consideration

Establishing a new company/branch/representative office

Any of the investors from all over the world who intends to develop a business and conducts activities in Taiwan, should apply to register a legal entity in the form of either a subsidiary or branch office in accordance with the related Taiwan regulations. Nevertheless, the representative offices are only allowed to sign contracts, to do quotation, price negotiation, tendering work and procurement for the corporation. With one advantage of a representative office is that the maintaining costs were much lower than a subsidiary or branch. You may know more details about the differences among the three entities at Business Type Comparison.

Alternatively, investors may consider participating in an existing Taiwanese enterprise or expending business activities in Taiwan by options of M&A, reinvestment and purchase of shares. In practice, there are so many factors such as tax issues, legal documents and valuation of assets will be taken into consideration while conducting M&A, reinvestment and purchase of shares. As a result, a general registration procedure can not be followed; instead, a case by case study or DD is more appropriated. If you were not only seeking for starting a business in Taiwan, you can directly contact us for any advance study. Our investment consultation service team will be at your service promptly.

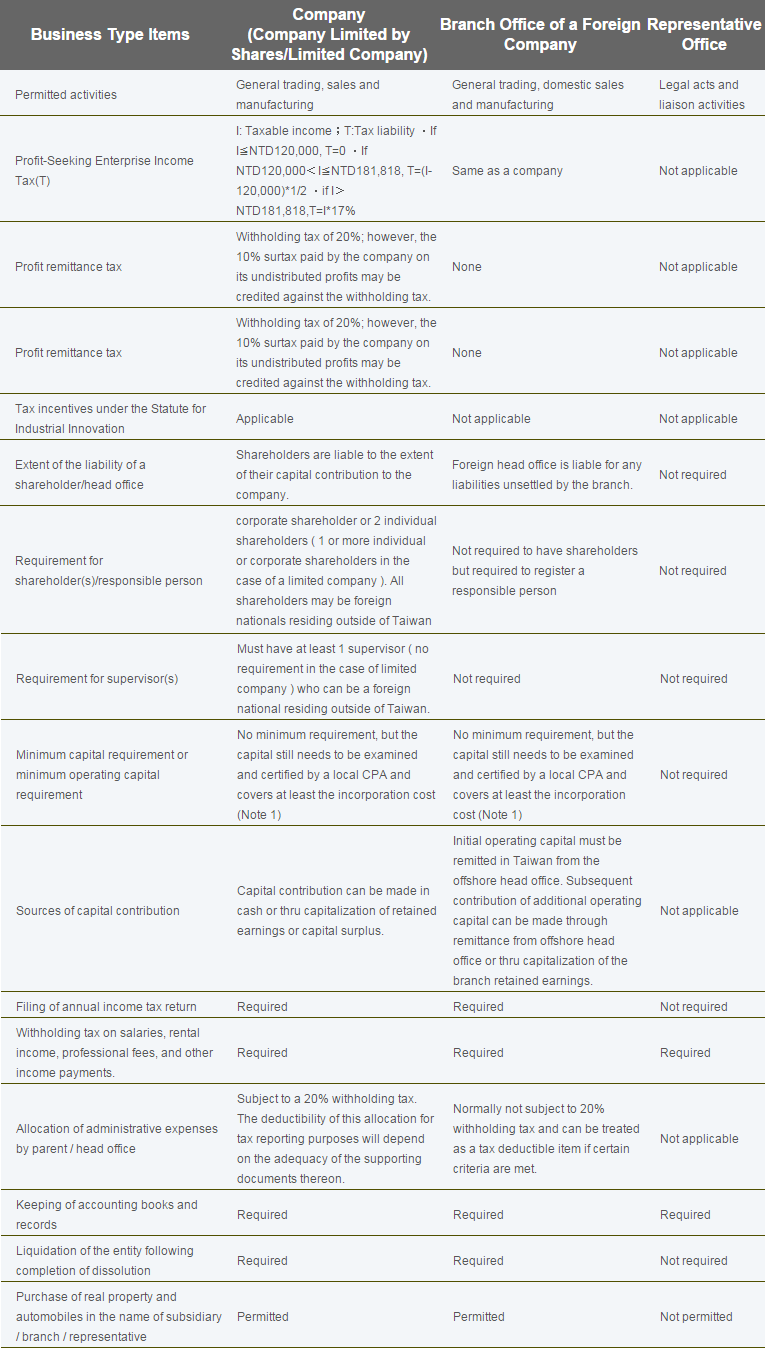

Business Type Comparison

§ Comparison of a limited company, a branch office and a representative office

| Business Type Items | Company (Company Limited by Shares/Limited Company) |

Branch Office of a Foreign Company | Representative Office |

|---|---|---|---|

| Permitted activities | General trading, sales and manufacturing | General trading, domestic sales and manufacturing | Legal acts and liaison activities |

| Profit-Seeking Enterprise Income Tax(T) | I: Taxable income;T:Tax liability .If I≦NTD120,000, T=0 .If NTD120,000<I≦NTD181,818, T=(I-120,000)* 1/2 .if I>NTD181,818,T=I*20% | Same as a company | Not applicable |

| Profit remittance tax | Withholding tax of 21%; however, the 10% surtax paid by the company on its undistributed profits may be credited against the withholding tax. | None | Not applicable |

| Tax incentives under the Statute for Industrial Innovation | Applicable | Not applicable | Not applicable |

| Extent of the liability of a shareholder / head office | Shareholders are liable to the extent of their capital contribution to the company. | Foreign head office is liable for any liabilities unsettled by the branch. | Not required |

| Requirement for shareholders / responsible person | corporate shareholder or 2 individual shareholders ( 1 or more individual or corporate shareholders in the case of a limited company ). All shareholders may be foreign nationals residing outside of Taiwan | Not required to have shareholders but required to register a responsible person | 1 representative person |

| Requirement for directors | Must have at least 3 directors ( between 1 and 3 in the case of a limited company ). All directors can be foreign nationals residing outside of Taiwan. | Not required | Not required |

| Requirement for supervisors | Must have at least 1 supervisor ( no requirement in the case of limited company ) who can be a foreign national residing outside of Taiwan. | Not required | Not required |

| Minimum capital requirement or minimum operating capital requirement | No minimum requirement, but the capital still needs to be examined and certified by a local CPA and covers at least the incorporation cost (Note 1) | No minimum requirement, but the capital still needs to be examined and certified by a local CPA and covers at least the incorporation cost (Note 1) | Not required |

| Sources of capital contribution | Capital contribution can be made in cash or thru capitalization of retained earnings or capital surplus. | Initial operating capital must be remitted in Taiwan from the offshore head office. Subsequent contribution of additional operating capital can be made through remittance from offshore head office or thru capitalization of the branch retained earnings. | Not applicable |

| Filing of annual income tax return | Required | Required | Not required |

| Withholding tax on salaries, rental income, professional fees, and other income payments. | Required | Required | Required |

| Allocation of administrative expenses by parent / head office | Subject to a 21% withholding tax. The deductibility of this allocation for tax reporting purposes will depend on the adequacy of the supporting documents thereon. | Normally not subject to 21% withholding tax and can be treated as a tax deductible item if certain criteria are met. | Not applicable |

| Keeping of accounting books and records | Required | Required | Required |

| Liquidation of the entity following completion of dissolution | Required | Required | Not required |

| Purchase of real property and automobiles in the name of subsidiary / branch / representative | Permitted | Permitted | Not permitted |

Procedures for Company Registration

- Apply for search and reservation of company name and business scope. Please provide 1 to 5 company names in Chinese in their order of priority and proposed business scope, the company names will be surveyed by the competent authority in the order of priority and only one name will be reserved if it is available .

- Apply for Overseas Chinese/ Foreign investment approval.

- Apply for approval for examination of investment capital.

- Apply for company registration.

- Apply for business registration.

- Apply for registration of importer/exporter -for trading business only.

- Apply for reporting designated representative of a foreign company for handling legal matters in the R.O.C.

- Apply for a tax code.

- Apply for search and reservation of company name and business scope. Please provide 1 to 5 company names in Chinese in their order of priority and proposed business scope, the company names will be surveyed by the competent authority in the order of priority and only one name will be reserved if it is available.

- Apply for Investment Approval and Recognition of Foreign Company and Registration of a Branch Office.

- Apply for business registration.

- Apply for registration of importer/exporter -for trading business only.

A pre-approval is required before applying for branch registration if the branch intends to conduct special business which is subject to additional requirements and regulations ruled by the competent authority.

Investors Preparation

Requirement For The Investors

§ Investors

The investors can be an individual or a juridical person, who should provide the passport or the registration certificate to verify his identity. If you were going to set up a branch, a foreign company outside of Taiwan is necessary. At least one shareholder (or representative) is needed for a limited company (or branch).

§ Capital

There is no minimum capital required for a new set up company in Taiwan. You can set up whatever the capital your company need. However, if you need an ARC in Taiwan, your company capital has to meet a minimum requirement to get the ARC.

§ Office

A register address is needed for a new company (or branch) set up in Taiwan. If you were not yet need an office to run business in Taiwan, there are many business centers that provide temporary virtual office. For considering the maintaining costs of a new start company, the virtual office will be a good choice.

§ Maintaining Costs

The minimum maintaining costs to run a company in Taiwan will be Tax Agent and office rental. Usually, CPA provides the Tax Agent service. The cost of Tax Agent depends on the scale of a company business running. The cost of office rental depends on what kind of office you need.

Investment Structure Considerations

§ Capital with Cash

Capital contributed by foreign investors should be approved in advance. The cash must come from outside of Taiwan, otherwise, the cash must be legally verified.

§ Capital with Equipment

An equipment owner can contribute equipment as capital to a profit-seeking enterprise and become a shareholder thereby. Thus, foreign investors can contribute cash, property, automated machinery or raw materials, trademark rights, property rights, patents, specialized skills and other intellectual property rights to a Taiwan profit-seeking enterprise as capital.

§ Capital with Intellectual Property/Know-how

An owner of intellectual property can contribute intellectual property or know-how as capital to a company and thus become a shareholder. Any excess of shares obtained by the shareholder over the cost of the intellectual property is subject to income tax.

Insurance Scheme for employees

§ Labor Insurance

Taiwan government has built up a complete labor insurance program in every way of taking care of laborers' life. The labor insurance program offered cash benefits include: maternity, injury or sickness, disability, old-age, death benefits and occupational accident medical benefits. Through the implementation of the labor insurance program, laborers obtain complete labor insurance protection.

Insured persons may participate in labor insurance program compulsorily or voluntarily. Usually, workers above 15 full years and below 65 years of age shall be insured under the labor insurance program compulsorily.

Insured persons in the labor insurance program shall be covered via the employers, or the organizations or institutes to which they belong as the insured units.

The cost of Labor Insurance Program in a enterprise is about to be 7% of the total wages.

§ National Health Insurance

The National Health Insurance program is a compulsory social insurance program. By law, every Taiwanese citizen with official residency or foreign national living in Taiwan with an Alien Resident Certificate (ARC), regardless of age, gender, or employment status, must enroll in the program. Also, this insurance program lasts an entire lifetime. No one may arbitrarily withdraw, except for those who lose their insurance eligibility (such as people who give up their Taiwan citizenship, move abroad, let their Alien Resident Certificate expire, or a person who goes missing). In this way, when laborers are ill, laborers can obtain appropriate medical care for a relatively small amount of money and make a faster recovery.

Insured persons in the National Health Insurance program shall be covered via the employers, or the organizations or institutes to which they belong as the insured units.

The cost of Labor Insurance Program in a enterprise is about to be 4.8% of the total wages.

§ Labor Pension

Under the Labor Pension Program, all employers are required to deposit 6% (or more) of a worker's monthly wages into an individual labor pension account managed by the Bureau of Labor Insurance, with ownership going to the worker. Business entities employing 200 or more workers shall decide through their respective labor unions whether to adopt an annuity insurance program. If no labor unions exists,with the approval obtained through a labor-management meeting and the central competent(the Ministry of Labor), a business entity may take out an annuity insurance that complies with the Insurance Act on behalf of those workers who choose, in writing, to take out an annuity insurance.

With Labor Pension Program, workers can enjoy a secure life after retirement, as employer contributed retirement funds can go wherever they go. A worker may begin collecting his or her pension payments upon reaching the age of 60, regardless of employment status. Workers with 15 years or more work seniority can receive monthly pension payments. Workers with less than 15 years of seniority can only receive a lump sum payment.

ARC & work Permit

While you are doing business in Taiwan, unless you engaged someone to work for you, it is important to get a working VISA to start your business.

Get your VISA and work Permit in Taiwan

- For Business Purpose

- For Employment Purpose

Foreign nationals who are interested in investing and will have a business trip in Taiwan for no more than six months, may apply to the ROC Embassy or consulate or Representative Office in the country of origin for a visitor visa. In that application, his/her Company's employed & job assigned letter, invitation letter, ongoing letters, and trading records such as L/C and remittance receipt shall be attached. However, if nationals from the designated countries list below applying for visitor visa must fulfill the "Procedures for Nationals of the Designated Countries Applying for Visitor Visas to the Republic of China (R.O.C.)" Designated Counties: Afghanistan, Algeria, Bangladesh, Bhutan, Burma/Myanmar, Cambodia, Cameroon, Cuba, Ghana, India (Identity Certificate), Iran, Iraq, Laos, Nepal, Nigeria, Pakistan, Senegal, Somalia, Sri Lanka, Syria.

A foreign national who is going to work in the ROC for a period of less than 180 days, the employer must apply to the Bureau of Employment and Vocational Training (BEVT) for a work permit first and then apply to the ROC embassy, consulate or representative office in the country of origin for a visitor visa.

- Investment Resident

- Employment Visa

A foreign national who is going to invest in the ROC for more than USD200, 000, should apply to the Investment Commission, MOEA, for a certificate of investment first and then submit an application form together with the original and a photocopy of passport and required documents to the ROC Embassy or consulate or Representative Office in the country of origin for a resident visa.

A foreign national who is going to work in the ROC for a period of more than 180 days, the employer in the ROC must apply to the Bureau of Employment and Vocational Training (BEVT) for a work permit first then the employee should submit an application form together with the original and a photocopy of passport and the work permit to ROC Embassy or consulate or Representative Office in the country of origin for a resident visa.

If foreign nationals who have entered the ROC with Visitor Visas are subsequently legally employed in the ROC, they may make the necessary change from their Visitor Visa into a Resident Visa in this country directly.

In accordance with ROC immigration law, Resident Visa holders are required to apply for the Alien Resident Certificate and Re-entry Permit at local service centers of the National Immigration Agency within 15 days starting from the next day of their arrival or the next day of receiving resident visa in Taiwan. They may stay in the ROC as long as the Alien Resident Certificate remains valid.

- For the nationals of the following countries are eligible for the visa exemption program, which permits a duration of stay up to 90 days:Austria, Belgium, Bulgaria, Canada, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Israel, Italy, Japan, Republic of Korea, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Monaco, the Netherlands, New Zealand, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Switzerland, U.K. , and Vatican City State.

- For the nationals of the following countries are eligible for the visa exemption program, which permits a duration of stay up to 30 days:Australia, Malaysia, Singapore, U.S.A..

- For the nationals of India, Thailand, Philippines, Vietnam, Indonesia, who also possess a valid visa or permanent resident certificate issued by U.S.A., Canada, Japan, U.K., Schengen Convention countries, Australia or New Zealand, are eligible for the visa exemption program, which permits a duration of stay up to 30 days.

The conditions and qualifications for a foreigner to work in Taiwan are difference. Roughly we separated the applicants into two identities. While you establish a company, branch, representative office, you have one quota for your representative (director or manager) to get the work permit . The other accompanies who want to work in Taiwan in your business were employee. There are difference qualifications for these two categories of applicants. We make a comparison bellow for your better understanding. If you need any more information, please directly contact us.

§ Comparison of qualifications of work permit for Director (Manager) and Employee

| Identity | Establish Duration | Qualifications | Education and Experience | Minimun wages |

|---|---|---|---|---|

| Director or Manager | Less than one year | Initial capital above NT 500,000 and 1/3 of the shares held by foreigners | No Requirement | No Requirement |

| More than one year | The business turnover more than NT 3M in one year | |||

| Employee | Less than one year | Initial capital above NT 5M and 1/3 of the shares held by foreigners | Bachelor degree with 2 yrs working experience Master degree- No working experience required |

NT 47,971 |

| More than one year | The business turnover more than NT 10M in one year |

Taxes & Stocks Investment

Taxes

§ Profit-Seeking-Enterprise Income Tax

| Net Income of the year ( NT$ ) | Current Tax Rate |

|---|---|

| 120,000 or less | None |

| Over 120,000 | 20% of total taxable income, but income tax liability may not exceed 50% of the portion of taxable income over $120,000 |

§ Value Added Tax (VAT)

§ Individual Income Tax

| Net Taxable Income of the year (NT$) | Tax Rate | Progressive Difference (NT$) |

|---|---|---|

| 0 - 520,000 | 5% | 0 |

| 520,001 - 1,170,000 | 12% | 36,400 |

| 1,170,001 - 2,350,000 | 20% | 130,000 |

| 2,350,001 - 4,400,000 | 30% | 365,000 |

| 4,400,001 - | 40% | 805,000 |

An individual is considered non-resident in Taiwan if he/she is not domiciled in Taiwan and stays in Taiwan for less than 183 days in a calendar year. In general, a non-resident taxpayer is not entitled to any personal exemptions or deductions -- income tax is computed on gross income and taxes are collected through withholding at source. Non-residents who have income not subject to withholding tax should file income tax return and pay tax according to the prescribed rates.

If an expatriate stays in Taiwan for less than 90 days in a calendar year, compensation received from a foreign employer is exempt from Taiwan income tax (if expatriates' residence state has an applicable treaty with Taiwan, generally the criteria could be prolonged to 183 days).

§ Withholding Tax

| Item | Withholding Tax Rates | |

|---|---|---|

| Income Category | Taxpayer Status | |

| Taiwan resident, profit-seeking enterprise with a fix place of business in Taiwan | Non-Taiwan resident, profit-seeking enterprise without a fix place of business in Taiwan | |

Dividend |

|

21% |

| Professional fees | 10% | 20% (for individual income derived from written articles, copyrighted books, etc. that do not exceed NT$5,000 for each payment, not applicable) |

Salaries and wages |

|

|

Interests |

|

|

| Rental income | 10% | 20% |

| Royalty | 10% | 20% |

Contest awards or lottery winnings |

|

|

| Pension income | 6% on the payment after deducting certain exempted income. | 18% on the payment after deducting certain exempted income. |

Other income |

|

|

| Capital gain | No withholding applicable (report the income by filing tax return) | Report the income and it is taxed at 20%. |

| Foreign enterprises engaging in international transportation, construction contract, machinery or equipment rental or rendering technical services, etc. which has obtained government approval to calculate its taxable income based on Article 25 of the Income Tax Act | - |

|

| Foreign motion picture company | - |

|

Tax Treaties

Withholding Tax Rates under Tax Agreements

| Income Item Country |

Dividends | Interest | Royalties |

|---|---|---|---|

| Non-treaty Countries | 20 | 15,20 | 20 |

| Australia | 10,15 | 10 | 12.5 |

| Austria | 10 | 10 | 10 |

| Belgium | 10 | 10 | 10 |

| Canada | 10,15 | 10 | 10 |

| Denmark | 10 | 10 | 10 |

| France | 10 | 10 | 10 |

| Gambia | 10 | 10 | 10 |

| Germany | 10 | 10,15 | 10 |

| Hungary | 10 | 10 | 10 |

| India | 12.5 | 10 | 10 |

| Indonesia | 10 | 10 | 10 |

| Israel | 10 | 7,10 | 10 |

| Italy | 10 | 10 | 10 |

| Japan | 10 | 10 | 10 |

| Kiribati | 10 | 10 | 10 |

| Luxembourg | 10,15 | 10,15 | 10 |

| Macedonia | 10 | 10 | 10 |

| Malaysia | 12.5 | 10 | 10 |

| New Zealand | 15 | 10 | 10 |

| Netherlands | 10 | 10 | 10 |

| Paraguay | 5 | 10 | 10 |

| Poland | 10 | 10 | 3,10 |

| Senegal | 10 | 15 | 12.5 |

| Singapore | 40* | N/A | 15 |

| Slovakia | 10 | 10 | 5,10 |

| South Africa | 5,15 | 10 | 10 |

| Swaziland | 10 | 10 | 10 |

| Sweden | 10 | 10 | 10 |

| Switzerland | 10,15 | 10 | 10 |

| Thailand | 5,10 | 10,15 | 10 |

| UK | 10 | 10 | 10 |

| Vietnam | 15 | 10 | 15 |

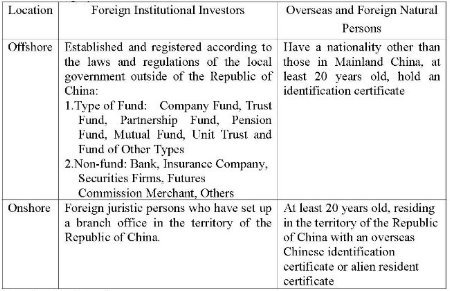

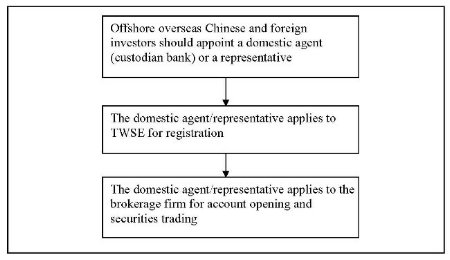

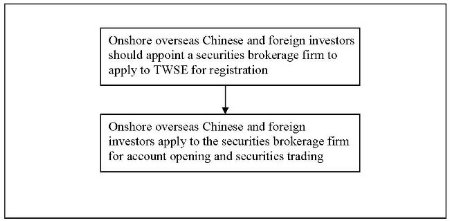

Stocks Investment

Investment on stocks listing on TWSE (OTC Market) and Emerging Stock Market

Investor Category

Application Procedures

Purchase of Land

- Residences

- Business sites, offices, shops, factories

- Churches

- Hospitals

- Schools for children of foreigners residing in Taiwan

- Embassies or consulates, public welfare institutions offices

- Cemeteries

For an inquiry of the " List of Reciprocal Nations for Foreigners Acquiring Land in Taiwain, R.O.C.", please link to the website of the Department of Land Administration, M.O.I.(URL:http://www.land.moi.gov.tw/).

© 2015 Asia One CPAs, Inc

© 2015 Asia One CPAs, Inc